Tencent to charge users in China for transferring money from WeChat Wallet to bank accounts

❤️ Click here: Wechat transfer money fee

May 2016 was a watershed moment, when Ant Financial made headlines on international media, as it hired Douglas Feagin as SVP for International Operations. For example, when your Chinese friend pay money for you at the restaurant, you can instantly transfer the amount using WeChat. It turned out to be a milestone for Alipay, as it was the first step to expand beyond payment service and to become a full-fledged financial services company: Ant Financial. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

If they do not confirm within 24 hours, the transferred money will be sent back to you. What is WeChat Pay? I hope you are having a fine day.

Tencent to charge users in China for transferring money from WeChat Wallet to bank accounts - Which agency should I work with?

Everything You Need to Know about Alipay and WeChat Pay Recently I have been getting a lot of questions from my American and European friends and colleagues about what Alipay and WeChat Pay do and what impact they have made on the payment industry, as increasingly more businesses start to realize their importance thanks to their media traction lately. So I decided to write a piece about Alipay and WeChat Pay about their history, how they shaped the ecommerce and payment industries in China, and their growing impact outside of China. Disclaimer: all views are my own, not related to my employer. Where Alipay and WeChat Pay came from Alipay Born in 2004, Alipay was first created as the payment department of Taobao, the B2C platform of Alibaba Group. It was right after eBay acquired Eachnet. To enhance its competitive advantage, Taobao tried to solve the biggest pain point in ecommerce in China at that point — the trust between seller and buyer. Back then, many conversations between sellers and buyers on Taobao failed to result in a transaction, often times because both sides suspected each other as fraudsters. So Taobao introduced Alipay as a 3rd party to temporarily hold the money paid by the buyer, and would not release the money to the seller until the buyer confirms that the product was received and in good condition. Successfully solving the trust issue, Alipay saw tremendous growth on Taobao plaform, and even started to be used on other platforms outside of the Alibaba ecosystem. Along the way, Alipay put a lot of emphasis on improving payment authorization rate in order to guarantee the best user experience. For its convenience and reliability, Alipay has also caught on the rising momentum of mobile commerce and became the dominant payment method. It turned out to be a milestone for Alipay, as it was the first step to expand beyond payment service and to become a full-fledged financial services company: Ant Financial. According to press report, Alipay currently has more than 600 million registered users, of which about 300 million are MAU and 80 million are DAU. WeChat and WeChat Pay WeChat Pay is the payment function of WeChat, which is widely seen as the WhatsApp of China. In fact, WeChat and WhatsApp, together with LINE and Kakao in Japan and Korea, were all inspired by Kik Messenger. Tencent saw Kik Messenger as the new form of IM messenger, because QQ and MSN were not built for the mobile era, and thus created WeChat in 2010. After years of improvement and growth, WeChat is no longer just a messenger like WhatsApp. It has rather built a huge social platform, including photo and moments sharing among friends and public accounts owned by independent publishers and brands. Before WeChat, the social media space in China was heavily influenced by Facebook, which induced a local copycat Renren. In 2012 when WeChat launched version 4. However, as mobile commerce took off and reshaped lifestyles, WeChat Pay quickly expanded its features and started competing with Alipay in many areas. Media reported that WeChat Pay has a bit less users than Alipay at 400 million, but WeChat has more than 800 million users, so there is significant potential. Alipay is part of Ant Financial, which is closely connected to Alibaba, and WeChat is part of Tencent. Therefore, the battle between Alipay and WeChat Pay is often regarded as a proxy war between Alibaba and Tencent, the two internet giants in China. In recent years, Alibaba and Tencent have been very active in strategic investments in successful early- to mid-stage startups operating in sectors with potential synergies. Financial services: As mentioned, Ant Financial has grown into a full-scale financial service company built on big data infrastructure, so Alipay is integrated with a wide spectrum of financial services, such as money market investment YuEBao , insurance service ZhongAn , credit rating Sesame Credit , personal credit line Ant Micro Loan , as well as SMB banking MYbank. However, WeChat Pay is not as strong in other aspects of financial services, besides offering money market investment accounts similar to YuEBao. In-App purchase: The in-app purchase function enabled WeChat to build a huge ecosystem of public accounts of brands and independent publishers. Brands can easily push notifications for sales and discounts to encourage in-app transactions. In fact many independent publishers have accumulated such humongous amounts of viewers — many articles with as many as 100,000+ viewers — that some of the editors have evolved to be content entrepreneurs valued at millions of dollars. Alipay, on the other hand, lacks similar social payment features. Mobile-CRM: Public accounts have been so widely adopted by global luxury retail and hotel brands that WeChat has become the best Mobile-CRM tool — recent survey showed that 92% of these global brands actively manage their WeChat public accounts. Unlike traditional CRM tools, WeChat enables brands to do better-targeted campaigns based on consumer persona using WeChat data, as well as 1-on-1 customer interactions via the messaging and chatbot channels. While on WeChat Pay, although Tencent was not established as an ecommerce store, Meilishuo and JD. Besides, WeChat Pay brought in Meituan as a partner for food delivery service, as well as 58. The lowest-cost version for the vendor can even be just a piece of paper printed with the QR code, which the shopper can pay by simply scanning that code. This capital-light and frictionless way of accepting payments was exactly why China has already become a largely cashless society. Both Alipay and WeChat Pay are accepted in the majority of restaurants and both support bill splitting. After dinner, movie tickets can be purchased on Alipay via Taopiaopiao or on WeChat Pay via Yupiaor. You may even run into Karaoke booths in shopping malls. Fully automated with WeChat Pay, you can check-in and pay by scanning QR code and even share your recorded songs on WeChat with your friends. Travel: Alipay has a direct connection with Airbnb and Uber, and both Alipay and WeChat Pay are connected with Didi Chuxing, which acquired UberChina last year. Hotels, flights and train tickets can also be booked in both apps via integrated partners. Other services: Alipay and WeChat Pay can handle a lot of tasks such as booking doctor appointments, paying for utilities, checking social security information, filing for tax, paying at gas stations, traffic tickets, and mails and packages, just to name a few. To summarize, benefiting from the large partner base of Alibaba and Tencent, Alipay and WeChat Pay have covered so many aspects of social life that they left very little room for competitors. Meanwhile, they continue to explore new payment scenarios and offer better and more comprehensive services in order to solidify their dominance within China. Moreover, they have already started expansion outside of China. The investment was very effective — by the end of 2016 Paytm claimed to have 177 million users out of the total 220-million smartphone user base in India, a staggering 80% market share. Later in Dec 2015, Ant Financial formed a partnership with Wirecard to process POS payments in Europe, as the first movement to tap into the European market. May 2016 was a watershed moment, when Ant Financial made headlines on international media, as it hired Douglas Feagin as SVP for International Operations. A graduate of University of Virginia and Harvard Business School, Mr. Feagin worked as the Head of Financial Institutions Group for Americas and Asia at Goldman Sachs. Feagin joined Ant Financial, it formed a series of partnerships around the world, including Paysbuy in Thailand for online-to-offline payments, Ingenico, Zapper and Concardis in Europe for mobile POS payments, and Verifone and First Data in the US. In July 2016, Ant Financial led a massive round of financing into M-Daq in Singapore, which a forex product for ecommerce platforms in the region. All of these deals were announced before the Nov 11 online shopping festival and the winter tourism seasons. Also, Alipay announced a partnership with Citcon in the US. For example, the first merchants in the US to sign up for Alipay in-store POS are duty-free stores in major airports like New York and San Francisco, high-end retail shops, hotels in Las Vegas, and Chinese restaurants in major cities. In the mean time, we have seen increasingly more ecommerce companies accepting Alipay and WeChat Pay, including many top tier global tech giants, rising sharing economy unicorns, and high-end global retailers. In order to better reach the local market in China — to provide a frictionless shopping experience with Chinese customers and to make it easier for Chinese businesses to advertise to a broader global audience — accepting Alipay and WeChat has become part of the core strategy of global expansion for many companies.

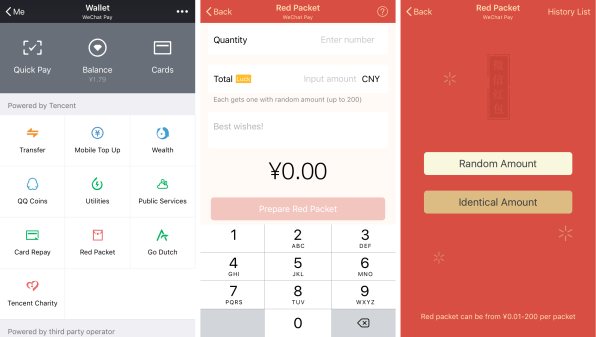

This is how you can pay in China everywhere with WeChat

For Australian merchants, the rate is usually between 1. In-App U You wechat transfer money fee integrate WeChat Pay or Alipay on your Apps. When the buyer has completed the payment, the amount will be allocated to a partner settlement bank for currency exchange. And WeChat Pay will pay a central role in this service strategy. Once you file your payment method, you will be asked to enter the six-digit WeChat pass code. WeChat, a Tencent-backed popular messaging application that boasts half a billion users, will start to charge individual users to transfer money from the app's digital wallet service to their personal bank accounts. How can custodes open WeChat Pay account. This account will let your customers to pay in RMB using WeChat Pay, and the payment will be able to settle in your overseas bank account. After dinner, movie tickets can be purchased on Alipay via Taopiaopiao or on WeChat Pay via Yupiaor. What currencies does Wechat Pay cover. While we are independent, we may receive compensation from our partners for featured placement of their products or services.